Heatwaves, Carbon Pricing and Why We Should Be Prepared for 2025 Carbon Tax

Oleh: Grace Sicilia Muchtar, pegawai Direktorat Jenderal Pajak

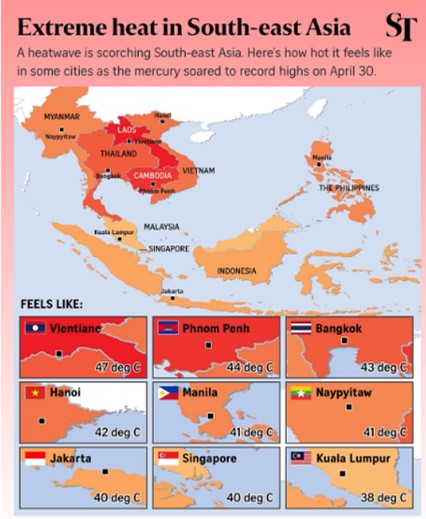

It's been months since the first heatwaves struck South East Asian countries. On April 2024, it was reported that the extreme weather has been so intense. Many schools across Thailand and Philippines were shut down and children had been sent home due to this hot weather. As of 3 June in India, there were 219 deaths from the heatwave and 25.000 others suffered from heat stroke while the temperatures in Delhi exceeded nearly 53°. It was considered the country’s hottest summer in 120 years.

The IPCC (Intergovernmental Panel on Climate Change) defines heatwaves as "a period of abnormally hot weather, often defined with reference to a relative temperature threshold, lasting from two days to months." Heatwaves occur as a result of climate change. As the world is getting older and crowder, people will consistently contribute in climate change. Thus, making heatwaves occurrence a yearly event.

The need to stop the global warming has been an issue since 1950's. United Nations Framework Convention on Climate Change (UNFCCC) gathered countries across the world and decided to officially making it all nation's effort with The Paris Agreement (Dec 12th, 2015). All countries of the world including Indonesia has signed the Nationally Determined Contributions (NDCs).

The NDC Press Release number 383/HUMAS/PP/HMS.3/11/2021 stated that Indonesia committed in reducing the Greenhouse Gas (GHG) emissions to 41% by the year of 2030 and Net-Zero Emission by the year 2060 or a lot faster than stated in Long-Term Strategies for Low Carbon and Climate Resilience 2050 (LTS-LCCR 2050).

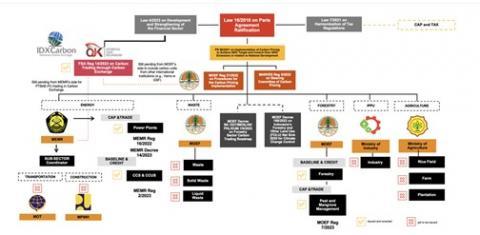

On October 29th 2021, our government officially promulgated Law number 7 of 2021 regarding Harmonization of Tax Regulations, in which officially making carbon as taxable goods. The law followed by the Regulation of the Minister of Environment and Forestry Number 21 of 2022 on Procedure for Implementation of Carbon Pricing where we can abbreviate the value of each unit of GHG Emissions generated from human activities and economic activities. Later on, our government launched the Indonesia Carbon Exchange (IDXCarbon) on September 26th 2023, in accordance with OJK Regulation (POJK) Number 14 of 2023 concerning Carbon Trading through Carbon Exchange.

According to article 13 of Law No 7/2021:

"Carbon tax is imposed on purchases of goods that contain carbon or activities that produce carbon emissions"

Meaning every purchasing of goods and activities that release emissions will be countable and subjected to carbon tax. The aim is for people to be more careful and mindful in lifestyles and activities that do not burden emissions.

“The subjects are individuals or entities who purchase goods containing carbon or activities that produce a certain amount of carbon emissions in a certain period”

This in line with the environmental law itself: the polluter pays principle. In environmental law, the polluter pays principle is enacted to make the party responsible for producing pollution responsible for paying for the damage done to the natural environment.

“The carbon tax rate is set IDR 30 (thirty Rupiah) per kilogram of carbon dioxide equivalent (CO2e) or equivalent unit”

Based on OECD report in 2018, the carbon tax rate of Indonesia is still considered in the low bracket compared to other countries, as shown below:

“The revenue from carbon tax can be allocated into climate change cause”

Derived from the purpose of the carbon tax itself, it is only appropriate that carbon tax revenues be allocated to climate change mitigation funds. In the 2024 state budget, the Ministry of Environment and Forestry's budget ceiling is IDR 8.38 trillion with the progress of realization until July 2024 amounting to IDR 3.12 trillion or 37.30%. Which means, the more we collect the state budget from carbon tax, the more it will be allocated into the climate change clause.

It is obvious that the main goal of carbon tax is to encourage changes in people's behavior towards reducing carbon emissions in accordance to the NDC target which is 41% by the year of 2030 and Net-Zero Emission by the year 2060. Hopefully by conducting this new tax, we can help prevent the damage toward our environment. Thus, prevent another heatwaves from happening across the globe including Indonesia.

Internet literature review:

- https://ppid.menlhk.go.id/berita/siaran-pers/6269/perpres-nilai-ekonomi-karbon-dukung-pencapaian-ndc-indonesia

- https://www.oecd-ilibrary.org/sites/058ca239-en/1/2/3/index.html?itemId=/content/publication/058ca239-en&_csp_=733ba7b0813af580090c8c6aac25027b&itemIGO=oecd&itemContentType=book

- https://www.pwc.com/id/en/services/environmental-social-governance/indonesia-carbon-pricing.html

- https://www.pwc.com/id/en/services/environmental-social-governance/indonesia-carbon-pricing.html

- https://www.straitstimes.com/asia/which-parts-of-asia-are-suffering-from-record-temperatures-and-how-long-will-the-heat-last

*)Artikel ini merupakan pendapat pribadi penulis dan bukan cerminan sikap instansi tempat penulis bekerja.

Konten yang terdapat pada halaman ini dapat disalin dan digunakan kembali untuk keperluan nonkomersial. Namun, kami berharap pengguna untuk mencantumkan sumber dari konten yang digunakan dengan cara menautkan kembali ke halaman asli. Semoga membantu.

- 435 views