Why VAT Rate Should be Adjusted

By: Yacob Yahya, the Directorate General of Taxes officer

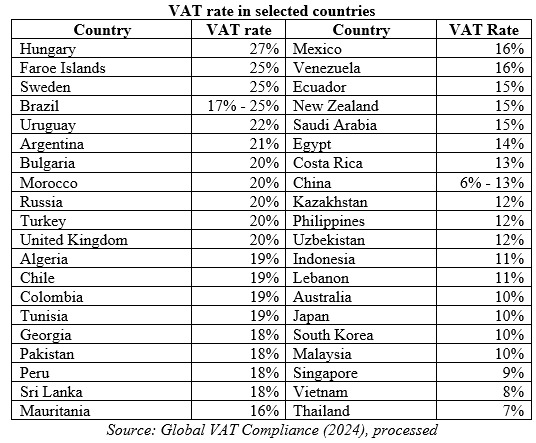

Minister of Finance Sri Mulyani Indrawati confirmed that Value Added Tax (VAT) rate will be adjusted by 1 percent –from 11 percent to 12 percent– from January 1st, 2025 on. Public responded it clamorously. Some economists strongly believe that the VAT rate ascension will impact negatively towards real sector and people with small amount of revenue. We should discuss this claim thoroughly and carefully.

The adjustment of VAT rate is mandate of Law 7/2021 regarding Taxation Regulation Harmonization (Undang-Undang Harmonisasi Peraturan Perpajakan or abbreviated UU HPP). Beforehand, the government has increased VAT rate from 10 percent to 11 percent, since April 1st, 2022. This VAT rate hike was the first time ever in almost four decade, since the implementation of Law 8/1983 regarding Value Added Tax and Sales Tax on Luxurious Goods (UU PPN/PPnBM). Law 7/2021 imposes that VAT rate must be adjusted to 12 percent no later than January 1st, 2025.

According to Gale (2020) VAT, goods and services tax (GST), consumption tax, sales tax, or any other variety of its term, has been successfully applied in 168 countries. Raising VAT could be effective in collecting more state revenues, with efficient and administrable fashion.

In addition, Gale proposes that in order to avoid that VAT rate raise will affect economy contraction, state revenues should be spent to aggregate demand in short term. According to previous experience in April 2022, I strongly believe that the government conduct right policy in responding the raise of VAT rate. The government has provided scheme of VAT borne by the government (Ditanggung Pemerintah or DTP), for property and electric vehicle sectors. This tax facility still can be enjoyed this year.

As a result, Statistics Indonesia (Badan Pusat Statistik, 2022) recorded that inflation rate in April 2022 was 0,95 percent. This period booked 3,47 percent year-on-year (yoy) inflation rate (April 2021 to April 2022). All cities underwent inflation. At the end of 2022, yoy inflation rate was 5,51%.

It means Indonesia maintained the inflation rate properly despite the raise of VAT rate. In addition, Indonesia enjoyed 5,31% economic growth (Ministry of Finance, Audited Financial Report of Central Government, 2022).

VAT History and Characteristic

Compared to other type of taxes – for instance income taxes, excise taxes, and property taxes which have been implemented since centuries ago– VAT is relatively newly imposed (Gale, op. cit). The VAT was introduced in the beginning of 20th century, and was conducted widely about five decades ago. In 2016, VAT contributed for more than 20 percent of OECD tax revenue. Hence, Sijbren Cnossen, a leading tax expert from Maastricht University in the Netherlands, claimed that the spreading of VAT implementation was “the most signifi cant development in the field of taxation in the past 50 years” (Cnossen, 2011, via Gale, op. cit).

In case of Indonesia, it was officially applied in 1984 via Law 8/1983. In last five years, VAT contribution towards taxation revenue has been increasingly significant (Ministry of Finance, Audited Financial Report of Central Government, 2020-2023; Law of State Budget, 2024-2025, data processed). We realized VAT revenue Rp453,59 trillion in 2020; Rp548,40 trillion in 2021 (20,90% growth); Rp694,78 trillion in 2022 (26,69% growth); Rp749,87 trillion in 2023 (7,93% growth). This year, VAT is targeted to fulfill Rp811,36 trillion (8,20% growth).

Next year, imposed by Law 62/2024 regarding 2025 State’s Budget (UU APBN 2025), taxation revenue is targeted to aim 2.490,91 trillion, and VAT is expected to realize 945,12 trillion rupiah (16,49% growth).

Gale (op. cit.) also highlighted that VAT is more consistent rather than other taxes, as well as able to avoid distortion.

Tax Justice

However, critics strongly believe that the raise of VAT rate could harm small enterprise, low-income households, and other vulnerable stakeholders.

Recently Chief of National Economic Council, Luhut Binsar Pandjaitan, has stated to the press that there is large opportunity to postpone the VAT rate adjustment –while the Government prepare social protection scheme towards people deeply affected by VAT rate ascension. It is essential that the Government provide type of social protection properly. Social protection program (perlindungan sosial) is the key element to guarantee that VAT rate adjustment would not affect people’s purchasing power.

Thus, providing VAT borne by the government facility aforementioned is right policy. Furthermore, Law 8/1983 jo. Law 7/2021 guarantee that essential needs, such as basic needs product, rice, soy, fruits and vegetables, milk, public transportation service, healthcare service, insurance service, education service, and many more are exempted from VAT. VAT exemption is also applied towards strategic goods, which are expected to boost economic growth and to flourish investment climate.

Moreover, the raise of tax revenue, in this case VAT, is extremely needed to guarantee public service and state budget sustainability. State would be able to guarantee providing healthcare facilities, proper school buildings, nutritious lunch for students, and social security programs.

*) This article expresses the author's personal views and does not represent the stance of the institution.

Content available at this page can be copied and utilized for non-commercial purposes. However, we urge users to mention sources of content being used by hyperlinking or referring to original page. Hopefully it helps you. Thank you.

- 717 views